Comprehensive Guide to Liquid Staking Crypto Coins: Unlocking New Possibilities in Cryptocurrency Investment

In the rapidly evolving universe of cryptocurrencies, liquid staking crypto coins have emerged as a groundbreaking innovation, disrupting traditional staking paradigms and offering unprecedented flexibility, liquidity, and earning potential to investors. This comprehensive guide explores the intricacies of liquid staking, its advantages, operational mechanisms, risks, and why platforms like jpool.one are leading the way in providing cutting-edge solutions for crypto enthusiasts worldwide.

Understanding the Concept of Liquid Staking Crypto Coins

At its core, liquid staking crypto coins is a practice that marries the security and passive income benefits of traditional staking with the liquidity and flexibility traditionally absent in conventional staking models. Conventional staking involves locking up your assets—a process that makes your holdings inaccessible for trading or other activities until the lock-up period ends. In contrast, liquid staking introduces tokenized representations of staked assets, enabling users to retain liquidity while earning staking rewards.

How Liquid Staking Works

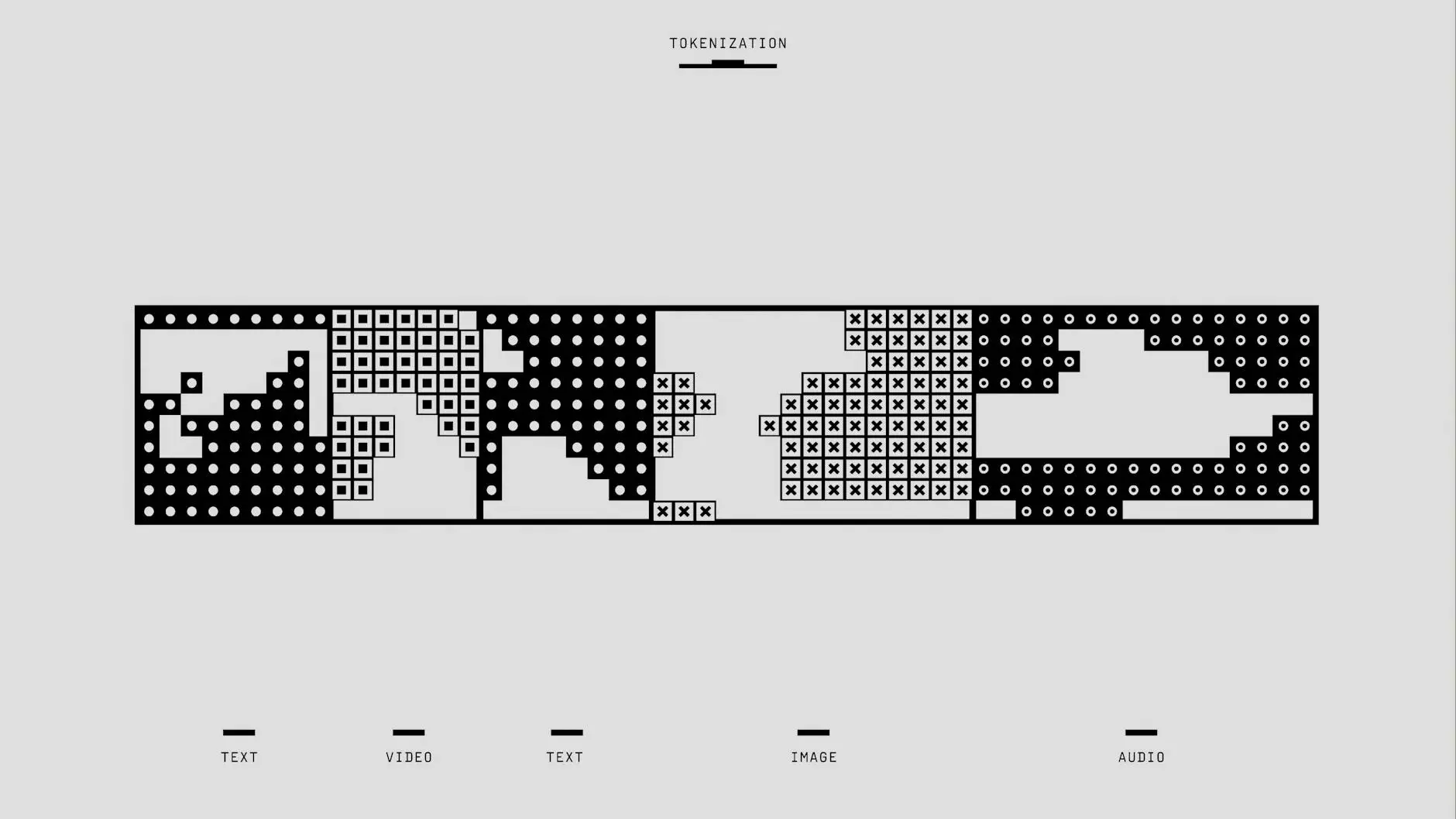

The mechanism of liquid staking crypto coins revolves around smart contracts and tokenization protocols. Here's a detailed breakdown:

- Deposit and Lock-up: Investors deposit their crypto coins (e.g., Ethereum, Solana, or other proof-of-stake tokens) into a staking protocol.

- Tokenization: On deposit, the protocol issues a liquid token—a derivative that represents the staked position, such as stETH for Ethereum or similar tokens for other blockchains.

- Liquidity and Trading: These tokens can freely trade on secondary markets or be used in other DeFi applications, enabling liquidity and earning further yield.

- Rewards Accumulation: Token holders earn staking rewards proportional to their staked amount, which are reflected directly in their liquid tokens.

- Unstaking and Withdrawal: When investors decide to exit, they burn the liquid tokens to retrieve their initial assets plus accrued rewards.

Benefits of Liquid Staking Crypto Coins

The greatest appeal of liquid staking is its capacity to unlock new opportunities for crypto investors. Some of the most significant benefits include:

1. Enhanced Liquidity and Flexibility

Traditional staking ties up your assets, limiting their usability. Liquid staking transforms this dynamic by providing tokenized representations of the staked assets, which can be traded or utilized in DeFi protocols, thereby enhancing liquidity and enabling active portfolio management.

2. Earning Multiple Streams of Income

Investors can earn staking rewards and simultaneously employ their liquid tokens across various DeFi platforms, such as lending, borrowing, or yield farming, exponentially increasing earning potential.

3. Reduced Entry Barriers and Better Capital Efficiency

Liquid staking lowers the barriers for participation, making it easier for smaller investors to get involved without locking up assets for long periods, thus improving overall capital efficiency.

4. Risk Mitigation and Security

By utilizing reputable liquid staking platforms like jpool.one, investors benefit from enterprise-grade security, transparency, and the ability to quickly react to market changes or staking lock-up periods.

Technical Aspects and Security Considerations in Liquid Staking

Implementing liquid staking crypto coins requires sophisticated smart contract architectures that ensure security, accuracy, and fairness. Critical aspects include:

- Smart Contract Safety: Ensuring that staking contracts are audited thoroughly to prevent exploits.

- Tokenomics and Incentives: Designing robust incentive mechanisms to align the interests of stakers and the protocol.

- Decentralization: Maintaining decentralization to prevent single points of failure and foster trust.

- Compliance and Governance: Implementing transparent governance structures for protocol upgrades and dispute resolution.

Liquid Staking Crypto Coins and the DeFi Ecosystem

The synergy between liquid staking crypto coins and decentralized finance (DeFi) platforms has opened an era of integrated financial products. Investors are no longer restricted to passive staking; instead, they can leverage their tokenized assets across multiple platforms to amplify earning potential.

For example, liquid staked tokens like stETH can be used as collateral for loans, provide liquidity in decentralized exchanges (DEXs), or participate in yield farming routines. This interconnected ecosystem enhances both liquidity and profitability, creating a vibrant, dynamic financial environment.

Why Choose Platforms Like jpool.one for Liquid Staking

Leading platforms such as jpool.one have gained prominence for their innovative, secure, and user-friendly liquid staking solutions. Key reasons to trust and use their services include:

- Secure Infrastructure: Rigorous security audits and multi-layered safeguards.

- Transparency and Governance: Community-driven protocols with transparent operations.

- High-Quality Customer Support: Dedicated support teams to assist with onboarding, technical issues, and protocol understanding.

- Wide Range of Supported Tokens: Offering liquid staking for multiple cryptocurrencies, providing diversification options.

- Integration with DeFi Platforms: Seamless access to liquidity pools, lending, and other DeFi products.

Risks and Challenges in Liquid Staking

While the benefits are substantial, it is crucial to be aware of potential risks associated with liquid staking crypto coins.

- Smart Contract Vulnerabilities: Flaws in protocol code can lead to loss of funds.

- Market Risks: Fluctuations in cryptocurrency prices can affect the value of both the underlying assets and the liquid tokens.

- Liquidity Risks: In turbulent markets, liquid tokens may face reduced demand, impacting their usability and value.

- Regulatory Risks: Evolving legal frameworks around staking and DeFi could introduce compliance issues.

It is essential for investors to conduct thorough due diligence, understand their risk appetite, and choose platforms with strong security measures, like jpool.one.

The Future of Liquid Staking Crypto Coins

The landscape of liquid staking crypto coins is poised for exponential growth. Innovations such as cross-chain staking, integration with layer-2 solutions, and improvements in protocol security will exponentially increase adoption. As institutional interest ramps up, and regulatory clarity improves, liquid staking is projected to become a fundamental component of the crypto economy.

Furthermore, advances in decentralized autonomous organizations (DAOs) will facilitate more community governance, making liquid staking protocols more democratic, transparent, and aligned with user interests. Platforms like jpool.one are at the forefront, helping shape this future with innovative solutions and user-centric designs.

How to Get Started with Liquid Staking Crypto Coins

If you're considering entering the realm of liquid staking, here are actionable steps to guide your journey:

- Research and Select a Reputable Platform: Look for security, transparency, and user reviews—jpool.oneticks these boxes.

- Create a Secure Wallet: Use reputable wallets compatible with your chosen platform and ensure you follow best practices for digital security.

- Deposit Funds: Transfer your crypto assets to the platform, following all protocol instructions carefully.

- Stake Your Tokens: Initiate the staking process, receive your liquid tokens, and understand their utility and constraints.

- Utilize Your Liquid Tokens: Engage in DeFi activities, trade, lend, or provide liquidity to boost your earnings.

- Monitor and Manage Your Investment: Keep track of market conditions, staking rewards, and platform updates to optimize your returns continually.

Conclusion: Embracing the New Era of Cryptocurrency Investment

The rise of liquid staking crypto coins represents a significant leap forward in the quest for flexible, efficient, and secure cryptocurrency investments. By unlocking liquidity, enabling new earning opportunities, and fostering a more interconnected DeFi ecosystem, liquid staking is transforming how investors participate in the blockchain economy.

As the industry matures, choosing trusted providers like jpool.one will be paramount to harnessing the full potential of this innovative financial mechanism. Whether you're a seasoned trader or a newcomer exploring the crypto space, embracing liquid staking can empower you to maximize your assets' utility and growth prospects in this promising new frontier.

Invest wisely, stay informed, and enjoy the exciting opportunities that liquid staking crypto coins offer in shaping the future of decentralized finance.