The Ultimate Guide to Hiring a Remote Bookkeeper for Your Business

In today's fast-paced business environment, the need for efficient financial management has never been more crucial. As companies strive to enhance productivity and reduce overhead costs, remote bookkeeping has emerged as a preferred solution. This article delves deep into the world of remote bookkeepers, highlighting their benefits, roles, and how to effectively incorporate them into your financial strategy.

What is a Remote Bookkeeper?

A remote bookkeeper is a professional who manages financial records and transactions for businesses without the need for a physical office presence. Utilizing technology and accounting software, these experts handle various financial tasks, including invoicing, reconciliation, and reporting—all from a remote location.

Why Hire a Remote Bookkeeper?

Outsourcing your bookkeeping needs offers numerous advantages. Here are some compelling reasons to consider hiring a remote bookkeeper:

- Cost Efficiency: Hiring a full-time in-house accountant can be expensive. A remote bookkeeper typically charges only for the services provided, allowing you to save on salaries and benefits.

- Access to Expertise: Many remote bookkeepers have specialized knowledge and skills acquired from working with various businesses across industries. This expertise can be crucial for effective financial management.

- Scalability: As your business grows, your bookkeeping needs may evolve. Remote bookkeepers can easily adjust their services to scale with your business without the need for extensive onboarding.

- Increased Efficiency: By outsourcing bookkeeping tasks, you free up valuable time that you can reinvest into growing your business. This allows you to focus on what you do best.

- Technology Integration: Remote bookkeepers are usually well-versed in the latest accounting software, ensuring that your financial practices are up-to-date with industry standards.

Key Services Offered by Remote Bookkeepers

Remote bookkeepers offer a wide range of services tailored to meet the specific needs of your business. Here are some of the core services you can expect:

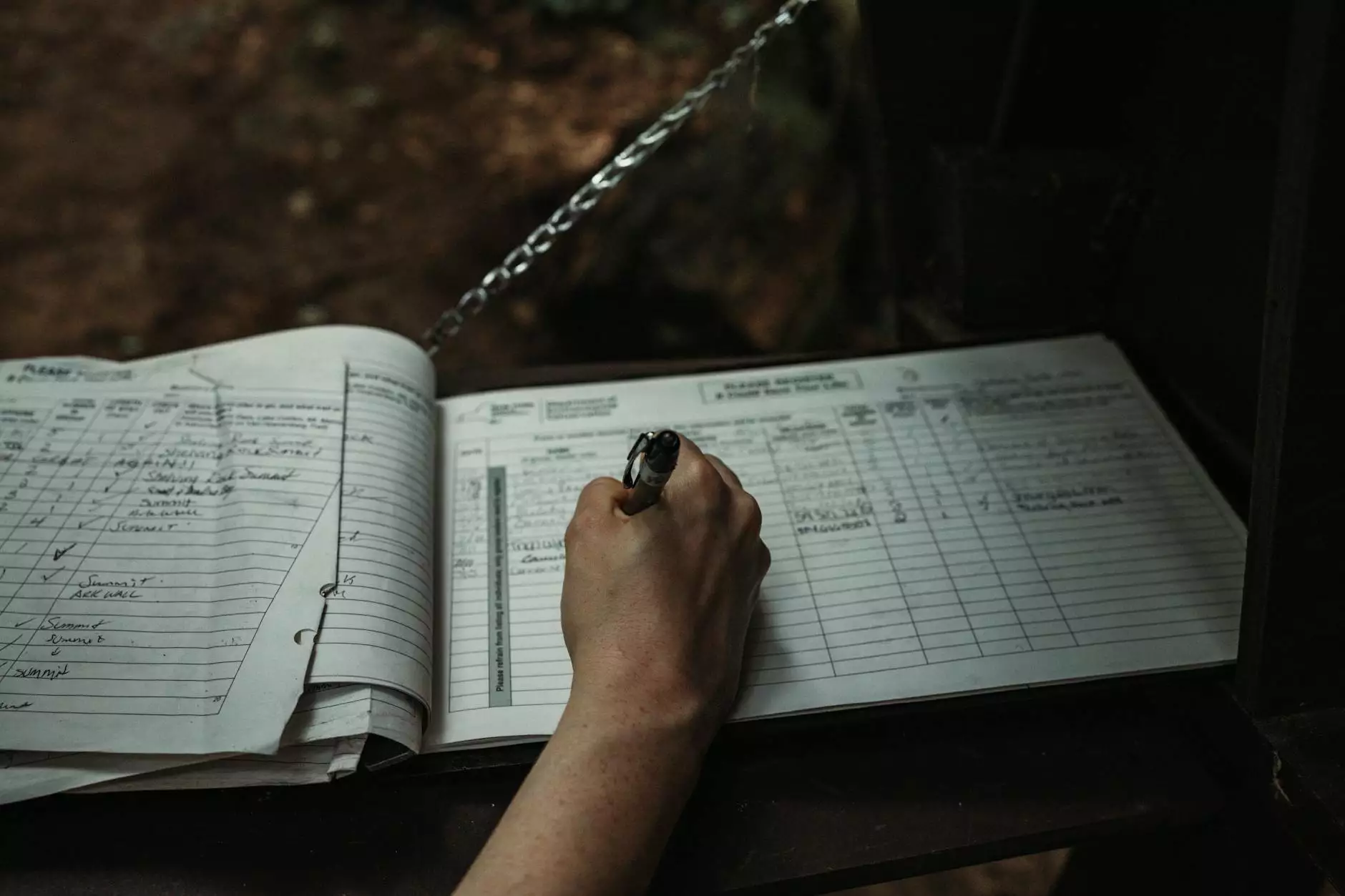

- Transaction Management: Recording daily financial transactions, including sales, purchases, receipts, and payments.

- Account Reconciliation: Ensuring that your bank statements and financial records align for accuracy.

- Financial Reporting: Preparing regular reports that provide insights into your business’s financial health, including balance sheets and profit-loss statements.

- Payroll Processing: Handling employee payments, tax calculations, and related paperwork efficiently.

- Tax Preparation: Assisting in the preparation of tax returns and ensuring compliance with tax regulations.

How to Choose the Right Remote Bookkeeper

Not all remote bookkeepers are created equal. Here’s a comprehensive guide to help you find the right fit for your business:

1. Assess Your Needs

Before you start searching for a remote bookkeeper, clearly outline your specific bookkeeping needs. Identify the core services you require and how often you’ll need them.

2. Check Qualifications and Experience

Look for candidates with relevant qualifications, such as a degree in accounting or finance, and significant hands-on experience in bookkeeping, especially within your industry.

3. Review Technology Skills

Ensure that the remote bookkeeper you choose is proficient in popular accounting software like QuickBooks, Xero, or FreshBooks, which will enhance collaboration and communication.

4. Ask for References

Consider reaching out to previous clients for feedback on their experiences. This can provide valuable insights into the bookkeeper's reliability and accuracy.

5. Consider Their Communication Skills

Since your interaction will mostly be remote, strong communication skills are crucial. Ensure that the bookkeeper is responsive and can convey financial information clearly.

6. Understand Their Pricing Structure

Discuss pricing upfront. Whether they charge hourly rates or fixed fees, understanding the cost structure will help you manage your budget effectively.

Benefits of Working with BooksLA

By choosing BooksLA for your remote bookkeeping needs, you tap into a wealth of expertise and experience. Here’s what sets us apart:

- Tailored Financial Solutions: We understand that each business is unique. Our team offers customized bookkeeping solutions that align with your specific business needs.

- Proven Track Record: With years of experience serving a variety of industries, we have a demonstrated history of delivering accurate and efficient bookkeeping services.

- Full-Service Offering: Beyond bookkeeping, we offer comprehensive financial advising and consulting services to ensure you have the support necessary for growth.

- Commitment to Technology: We leverage the latest technology in bookkeeping to provide real-time insights into your financial status and trends.

- Alliance of Experts: Our team consists of seasoned accountants and financial strategists who work closely with you to optimize your financial operations.

Conclusion

As businesses navigate the complexities of financial management, the role of a remote bookkeeper is more critical than ever. By outsourcing these tasks, not only do you save costs, but you also gain access to expertise that can propel your business forward. Whether you’re a small startup or a large corporation, BooksLA is here to assist you in achieving your financial goals through our exceptional remote bookkeeping services.

Contact Us Today!

Ready to elevate your financial management practices? Contact BooksLA today to discuss how our remote bookkeeping services can drive success for your business!